wake county nc tax deed sales

Generally the minimum bid at an Wake County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

Forging Ahead On Affordable Housing

Just remember each state has its own bidding process.

. In North Carolina the County Tax Collector will sell Tax Deeds to winning bidders at the Wake County Tax Deeds sale. Property tax in North Carolina is a locally assessed tax collected by the counties. Tax Deeds for properties located in the following counties are sold at North Carolina county tax sales.

There is no mortgage tax in North Carolina. The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills. To view instructions on retrieving a full listing of real estate billing and delinquent files please visit our page for Real Estate Tax Bill Payment Files.

The Wake County sales tax rate is. The data files are refreshed daily and reflect property values as of the most recent countywide reappraisal. August 5 2021 Date Judgment Filed with Courts.

Use the Wake County Tax Portal to view property details research comparable sales and to file a real estate appeal online. The additional 050 local sales and use tax is for the benefit and purpose of the Research Triangle Regional Public Transportation Authority dba GoTriangle and is to be used only for public transportation systems. If you do not see a tax lien in North Carolina NC or property that suits you at this time subscribe to our email alerts and we will update you.

Start Your Homeowner Search Today. Get In-Depth Property Tax Data In Minutes. View sales history tax history home value estimates and overhead views.

Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Sheriff Sales auctions in Wake County NC are most often held in the nearby courthouse at least once per month. Commencement of any of these actions will result in additional costs andor fees being added to the unpaid bills.

The full Wake County real estate file is available in the following formats. Sign Up Log In. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more.

Search our database of Wake County Property Auctions for free. Yearly median tax in Wake County. According to state law the sale of North Carolina Tax Deeds are final and the winning.

Date of Sale. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. Help Center Buying a Foreclosure Buying a Bank Owned Home Blog Glossary.

The State Department of Revenue is responsible for listing appraising and assessing all real estate estate within the counties. Ad Be Your Own Property Detective. This document serves as notice that effective April 1 2017 Wake County by resolution levies an additional 050 local sales and use tax.

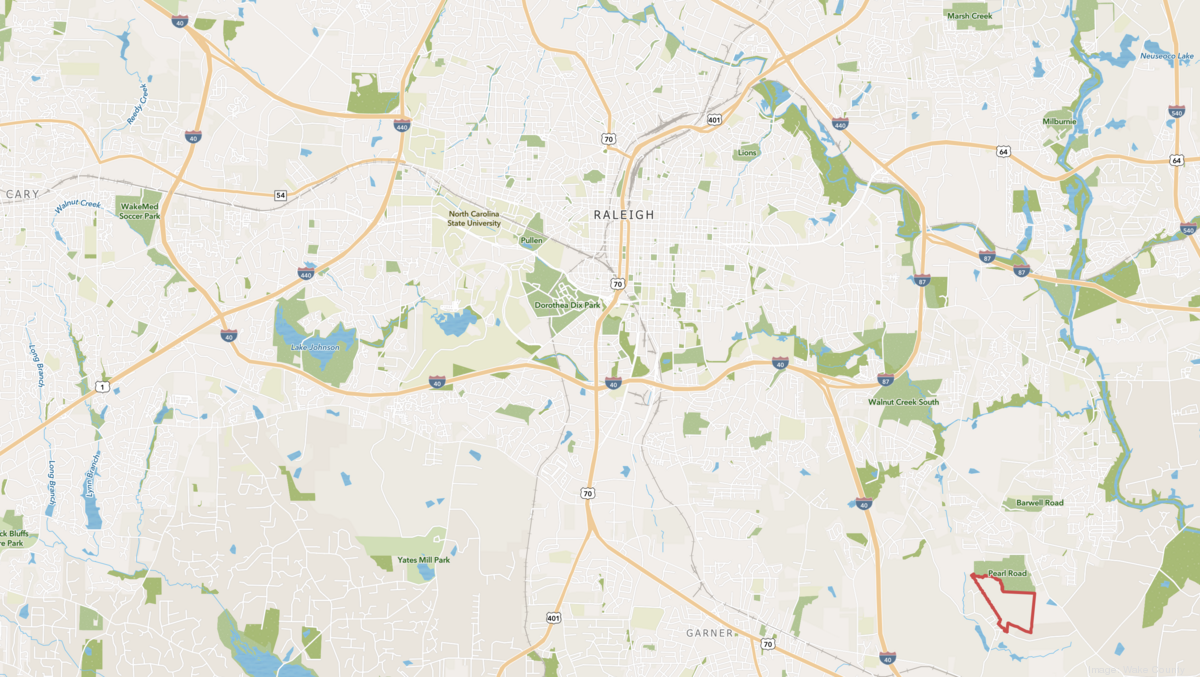

APN 186003 01 3313 000. The December 2020 total local. Vacant land located at 1125 DUKE FARM DR WAKE FOREST NC 27587.

The 2018 United States. Learn more about each countys individual tax sale process by clicking on the name of the county for which you are interested from the list below. This action is required by North Carolina General Statutes.

Wake County NC currently has 928 tax liens available as of February 23. The minimum combined 2022 sales tax rate for Wake County North Carolina is. The North Carolina state sales tax rate is currently.

All Foreclosure Bank Owned Short Sales Event Calendar. Main Street Wake Forest. Search For Title Tax Pre-Foreclosure Info Today.

Imposition of Excise Tax NCGS 105-22830a An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Detailed listings of foreclosures short sales auction homes land bank properties. Ownership sale information and property detail for all Wake County real estate parcels is available for download.

Find and bid on Residential Real Estate in Wake County NC. The department also collects gross receipts taxes. This is the total of state and county sales tax rates.

Data Files Statistics Reports Download property data and tax bill files. Check your North Carolina tax liens rules. The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300.

SEE Detailed property tax report for 305 E Hillside Dr Wake County NC. 933 Jones Dairy Road Wake Forest Date of First Action. State legislation requires each county to reappraise real.

In North Carolina the tax collector or treasurer will sell tax deeds to the winning bidders at the delinquent property tax sales. 100 County Tax DepartmentsTax Department OfficesTax OfficesTax Collections Offices and Tax Collectors and 267 municipal City or Town Tax Collectors. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25.

Wake County NC Sales Tax Rate The current total local sales tax rate in Wake County NC is 7250. Ad Find Tax Foreclosures Under Market Value in North Carolina. 081 of home value.

Wake County NC Sheriff Sale Homes. Find important information on the departments listing and appraisal methods tax relief and deferment programs exempt property. Wake County has one of the highest median property taxes in the United States and is ranked.

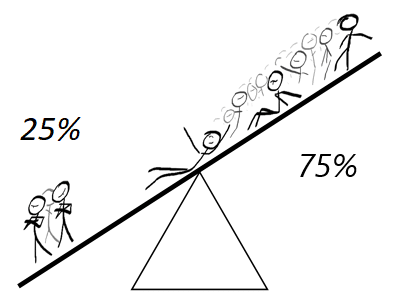

You can find more tax rates and allowances for Wake County and. The tax rate is one dollar 100 on each five hundred dollars 50000 or fractional part thereof of the. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Wake County NC at tax lien auctions or online distressed asset sales.

Wake County collects on average 081 of a propertys assessed fair market value as property tax. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. November 5 2021 Date of Sale.

Public notice of a Sheriff Sales list in Wake County NC will almost always be provided whether the docket is advertised in the local newspaper or posted online.

Forced Sale Of Jointly Owned Property Partition Action Attorney S Guide

December 2021 S Median Sales Price For Wake County Real Estate Was 411 000 Highest In 2021 And Of All Time Wake County Government

December 2021 S Median Sales Price For Wake County Real Estate Was 411 000 Highest In 2021 And Of All Time Wake County Government

December 2021 S Median Sales Price For Wake County Real Estate Was 411 000 Highest In 2021 And Of All Time Wake County Government

Comfort Suites In Richmond Ky States In America Best Places To Retire Lexington

Full Article Preventing Evictions After Disasters The Role Of Landlord Tenant Law

Wake County Register Of Deeds Extends Business Hours To 5 00 P M Wake County Government

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Entries Archive Strategic Finance

Free North Carolina Bill Of Sale Form Pdf Template Legaltemplates

December 2021 S Median Sales Price For Wake County Real Estate Was 411 000 Highest In 2021 And Of All Time Wake County Government

Texas Home My Dream Home Beautiful Homes Dream Mansion

December 2021 S Median Sales Price For Wake County Real Estate Was 411 000 Highest In 2021 And Of All Time Wake County Government

Biz Land Sale Shows Intense Demand For Raleigh Durham Property New Barbecue Spot Opens Raleigh Triangle Business Journal

Seller S Corner Is Here The Industry Exclusive Drip Cma Tool That Keeps You Top Of Mind And Keeps Your Sell My House Sell My House Fast Selling Your House