unemployment insurance tax refund 2021

View and print a copy of documents previously filed via the Internet. This act shall take effect immediately.

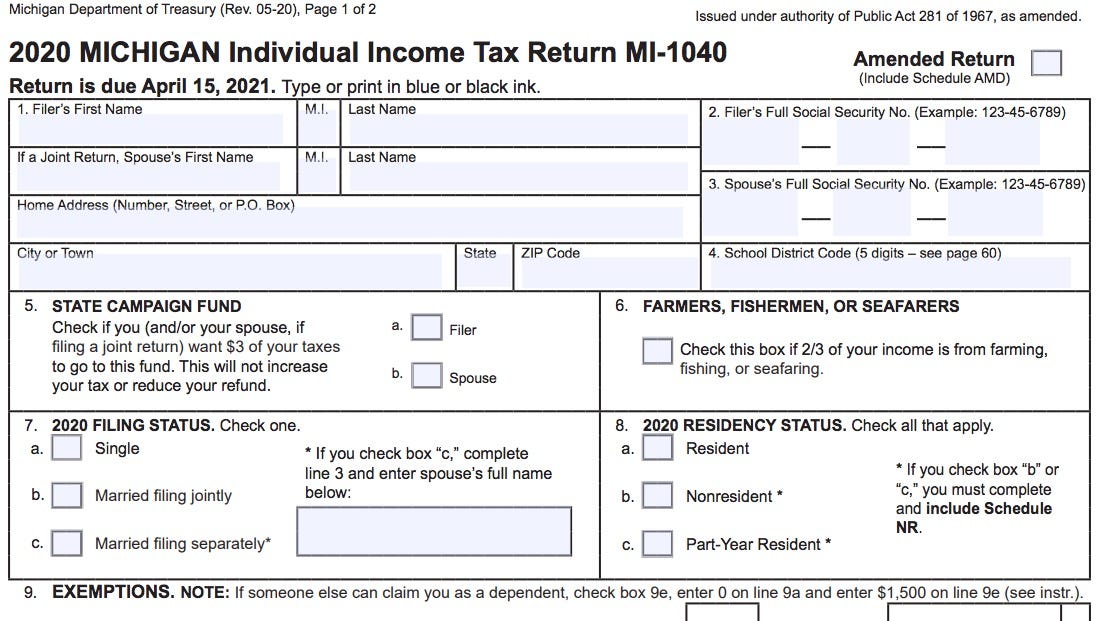

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion.

. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year. As taxable income these payments must be reported on your state and federal tax return.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. The IRS has sent 87 million unemployment compensation refunds so far. At this stage.

COVID Tax Tip 2021-87 June 17 2021. Generally in the first two years of a businesss liability the tax rate is set by law at 27 except for employers in the construction industry whose rate in the first two years is that of the average employer in the construction industry which is announced by UIA early each year. President Joe Biden signed the pandemic relief law in March.

Total taxable unemployment compensation includes the new federal programs. File a Quarterly Wage Report. The legislation granting an exclusion of up to 10200 of unemployment compensation from being reported on a tax return was only for tax year 2020.

You should receive. Premium federal filing is 100 free with no upgrades for premium taxes. The IRS has already sent out 87 million.

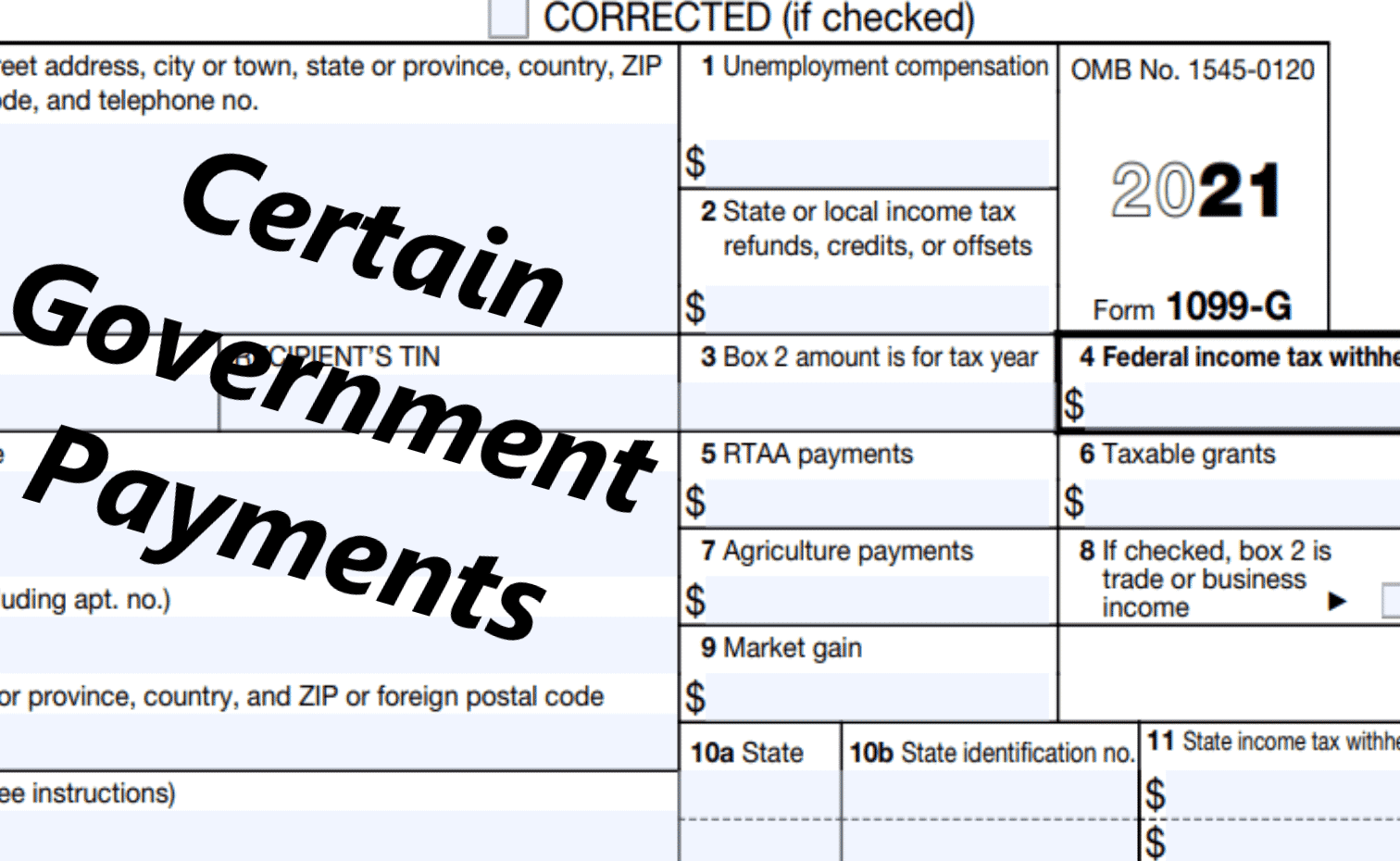

This applies both. Form 1099-G reports the total taxable income we issue you in a calendar year and is reported to the IRS. Under the new.

The American Rescue Plan Act of 2021 enacted on March 11 2021 suspended the requirement to repay excess advance payments of the premium tax credit excess APTC for tax year 2020. Pandemic-era relief laws have changed this temporarily. Prior to 2020 all unemployment benefits were considered taxable income.

If you already filed a 2020 return and reported excess APTC or made an excess APTC repayment you dont need to file an amended return or take any other action. April 1 2021 823 AM PDT. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not. President Joe Biden signed the pandemic relief law in March.

But when you claim unemployment insurance you must also complete a Schedule 1 form to report this additional income. Americans who filed their tax returns ahead of the recent stimulus package which has removed the tax burden on jobless benefits will soon get their refunds. The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your regular rate.

You can use TWS to file reports listing wages for 1 to 34000 employees or file zero-wage reports indicating your business had no employees. The American Rescue Plan exempted 2020 unemployment benefits from taxes. The IRS has identified 16 million people to date who.

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. Unemployment benefits received in 2021 are taxed as ordinary income like wages but are not subject to Social Security and Medicare taxes. The regular rules returned for 2021.

When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. 100s of Top Rated Local Professionals Waiting to Help You Today. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

Generally you report your taxes using Form 1040. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. Thats the same data.

To ease the burden on American households the American Rescue Plan Act waived federal income taxes on the first 10200 of unemployment benefits received in 2020. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT All unemployment claims run from Sunday to Saturday You may not file for unemployment before your actual layoff date If you file early it will code your claim for the prior week and could result in a flag being placed on your claim.

Line 7 is clearly labeled Unemployment compensation 3 The total amount from the Additional. Congress hasnt passed a law offering. Unemployment tax relief 2021.

The IRS has identified 16. That provision didnt apply to 2021 benefits so you may receive a tax bill for your jobless benefits last year. Tax and Wage System Overview.

Another way is to check your tax transcript if you have an online account with the IRS. But the rules changed back in 2021 when Congress did not extend that federal tax break on jobless benefits. Ad File your unemployment tax return free.

We Search Hundreds Of Tax Deductions To Get You The Biggest Refund Possible Guaranteed. Ad Simplify Your Tax Life And File Your Return Online With TurboTax. 6 taxpayers and unemployment insurance UI benefit claimants the 7 option to receive their payment in the form of a paper check.

No legislation has been passed where this same exclusion would be available on a 2021 tax return. Use the Internet Unemployment Tax and Wage System TWS to. 100 free federal filing for everyone.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020. 43 taxpayer due a refund of any State tax the option of receiving the 44 refund in the form of a paper check.

You must file Schedule 1 with your Form 1040 or 1040-SR tax return. 2021 Individual Income Tax Information for Unemployment Insurance Recipients.

State Income Tax Returns And Unemployment Compensation

How To Get A Refund For Taxes On Unemployment Benefits Solid State

1099 G Tax Information Ri Department Of Labor Training

1099 G 1099 Ints Now Available Virginia Tax

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

1099 G Form 2021 Irs Forms Zrivo

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

1099 G Unemployment Compensation 1099g

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Unemployment Compensation Are Unemployment Benefits Taxable Marca